WHY INVEST IN LEBANON

- Strategic Geographical Location

- Qualified Human Capital

- Unique Living Environment

- Quality Health Care

- Free Market Economy

- Developed Legal Framework

- Expanding Infrastructure

- Rich History & Culture

- Secure Banking System

- Secure Financial Environment

WHY INVEST IN HOTEL SECTOR

LEISURE ATTRACTION

in 2016, Beirut was voted as the Best International City for Food in the world. It also topped the list as one of the best 25 cities in the Word for its unique beaches and resorts, and vibrant nightlife in 2013.

A UNIQUE LANDSCAPE

Lebanon is endowed with a unique landscape and a natural heritage and a mild climate that distinguish it from all the neighboring countries. Jbeil was crowned the Arab tourism capital for 2016.

HIGHLY SKILLED LABOR FORCE

Many universities (AUB, Lebanese University, USJ, AUST, and La Sagesse University) offer tourism and hospitality management programs that serve the tourism supply chain.

TOURISM INVESTMENT INCENTIVES

A series of Exemptions and Tax breaks are offered by various ministries and government agencies to support national and foreign investors alike as part of its strategy to attract investments to growth promising sectors, in their set-up and operation phases.

KAFALAT

The loan guarantee agency, provides guarantees for loans

(up to USD 400,000) granted by commercial banks

to SMEs in the tourism sector.

CENTRAL BANK OF LEBANON

Provided by Commercial banks subsidized loans.

Limit up to USD 10 million to finance new projects

or expand existing projects in the tourism sector.

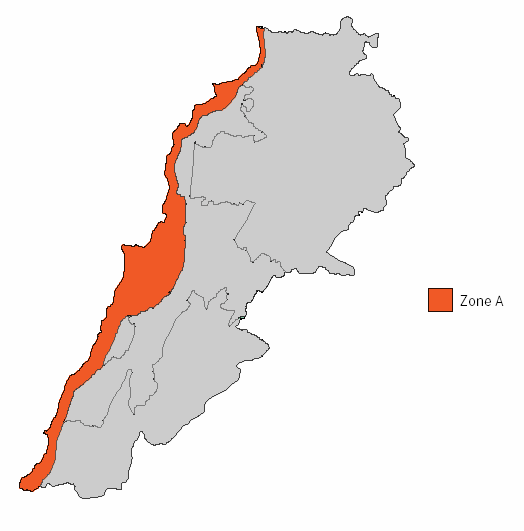

REGION BASED INCENTIVES

Eligibility Criteria

- Minimum Investment Requirement is USD 10 million

Incentives

- 100% Exemption from corporate income tax for two years provided that the company’s shares are listed in the Beirut Stock Exchange. In this case, the effective negotiable shares should be no less than 40% of the capital of the company

- Work permits for various categories, exclusively needed for the project, provided that at least two Lebanese nationals are employed for each foreigner. All employees should be registered with the National Social Security Fund.

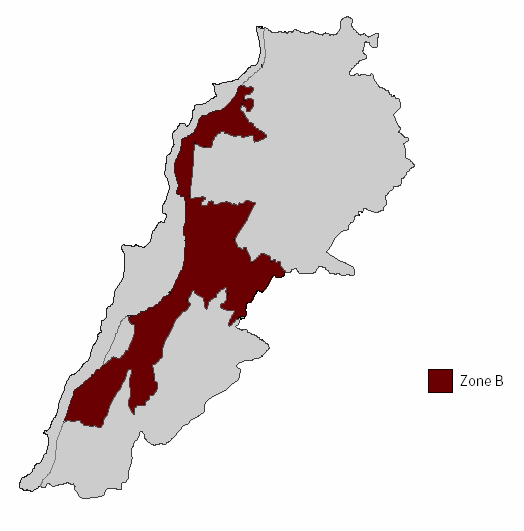

Eligibility Criteria

- Minimum Investment Requirement is USD 4 million

Incentives

- 50% reduction on corporate income tax and taxes on project dividends, for a period of five years. The reduction shall be applicable as soon as excavation works for the project commence, in accordance with the provisions of the Law.

- Work permits for various categories, exclusively needed for the project, provided that at least two Lebanese nationals are employed for each foreigner. All employees should be registered with the National Social Security Fund.

Eligibility Criteria

- Minimum Investment Requirement is USD 1 million

Incentives

- A 100% exemption from corporate income tax and taxes on project dividends for a period of 10 years. The exemption shall be applicable as soon as excavation works for the project commence, in accordance with the provisions of the Law.

- Work permits for various categories, exclusively needed for the project, provided that at least two Lebanese nationals are employed for each foreigner. All employees should be registered with the National Social Security Fund.

PACKAGE DEAL CONTRACT (PDC)

ELIGIBILITY CRITERIA

Minimum Investment Requirement is USD 15 million Minimum Number of Jobs Required: 200* * The number of job created can be reduced by 20% (to 160 jobs) provided that the investor shall allocate at least 25% of them to technical and professional training schemes in the tourism eld. The full training program will be subject to IDAL’s board approval.

INCENTIVES

- 100% exemption from Corporate Income Taxes for up to ten years starting as from the commencement date of the exploitation of the project.

- 100% exemption of Taxes on Project Dividends for up to ten years starting as from the commencement date of the exploitation of the project.

- Up to 50% Reduction on Work and Residence Permit Fees regardless of their category and depending on the number of permits required. Also the value of the certificate of deposit entrusted to the Housing Bank shall be reduced by half.

- Up to 50% Reduction on Construction Permit Fees related to the buildings to be established & needed for the execution of the project benefiting from the provisions of the Package Deal Contract.

- 100% exemption from Land Registration Fees at the Real Estate Register and from fees needed for annexation, sub-division, mortgage and registration of lease contracts at the Real Estate Register.

- Obtaining Work Permits of all categories provided that the Package Deal Contract preserves the interests of the local labor force through employing at least two Lebanese nationals against one foreigner, and registering them in the National Fund for Social Security.

EXEMPTION OF IMPORTED HOTEL EQUIPMENT FROM CUSTOMS DUTIES

Imported Hotel Equipment is exempt from certain duties provided that the operating period is for at least 10 years. Imported buses for tourism agencies are also exempt from customs duties. Touristic establishments classified as artisanal are exempt from corporate income tax. For more information on these exemptions please refer to the Ministry of Finance website on www.finance.gov.lb

WELL WORTH THE VENTURE

MEGA PROJECT

60-km Skiing Cross-country Telesiege and Teleferique linking the Ski Resort Mountain Summits from Faraya to Cedars

RESORTS

- Beach Resorts & Leisure Ports

- Health Farm Resorts

- Hotel & Golf Resort

BOUTIQUE HOTELS

- Including guesthouses

- Hotel & Restaurant Michelin Star venture with a winery

- Ecotourism

MID-SCALE HOTELS

Religious Pilgrimage